Ever wondered where all of your money goes?

The answer lies in your budget. If you are struggling to make a budget, then you are not alone. It is really disheartening to know 61% of Americans don’t have a budget according to the NFCC survey.

Budget is the foundation stone of your finances. Because you must have set some financial goals for your life. It can be paying off all your debt, saving for retirement, become financially independent or it can be travel the world.

To achieve all those goals, you need money. Right?

But the reality is our income is very limited and we have to make plenty of expenses. So how to fulfill our dreams?

The answer is with budgeting. For this very reason, I said earlier that, budget is the foundation of our financial planning.

Nothing is impossible, if you wisely budget your limited income, you can easily achieve all your financial goals – you can pay off your debt fast, become a proud homeowner and have a great holiday with enough funds in your bank to enjoy the retirement days.

Where to start?

When it comes to budgeting, trust me I’ve gone through this hell.

I’m sure you’d agree with me.

You must have heard about:

- Zero-based budget

- 50/30/20 budget

- Cash envelope system

And above all of them, some experts suggest the percentage method and so on. All these methods seem to be very complicated and are more suitable for expert budgeters.

As a beginner, you must ask yourself, are all these methods really going to help me?

In my opinion, as a

I’ll show you how to do it, let’s dive in!

Requirements

To make a budget you just need a paper or notepad and a pen. If you are tech-savvy, you may use excel/worksheet or app, but the basic principle remains the same. It doesn’t matter.

As we all know, most of us are paid bi-weekly. But here I’m taking you through a monthly budget because some expenses are incurred once a week or not arises every week. So to get the correct picture of your finances, I’m showing you a monthly budget.

Steps in making a budget

1. Gather all the information

Collect all the statements, bills, and other documents related to payments and receipts.

- Statements – Bank account statement, Credit card statement, Insurance payments.

- Direct debits – All auto pay or direct debit payments.

- Online payments – All online payment invoices – Amazon, Hulu or Netflix.

- Monthly bills – Utilities, water & sewage, cell phone, internet, cable.

- Grocery bills – Shopping at supermarkets, malls or nearby convenience stores.

- Debt payments – Mortgage statement, student loan and car payment documents.

- Cash payments – Don’t forget all those cash payments.

- Tax documents – Property tax, income tax.

- Incomes – Salary, bonus, commission, dividend, interest and other incomes.

- Gifts – monetary gifts received from family or friends.

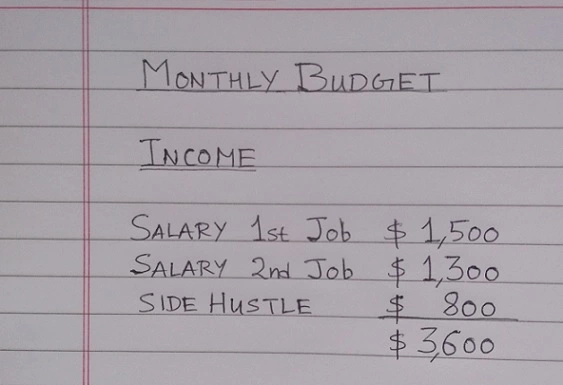

2. Determine your income

Determine your monthly income from all sources. If there are more earning members in the family, then add their income as well. And if you are paid weekly or bi-weekly, add them all to reflect the correct picture of your monthly income. Sources of income:

- Bi-weekly or monthly take-home salary.

- Bonus/overtime.

- Income from self-employment/business or freelancer income·

- Income from rental property.

- Commissions received.

- Dividend/interest received.

- Income from side hustles.

- Gifts/grants or scholarships.

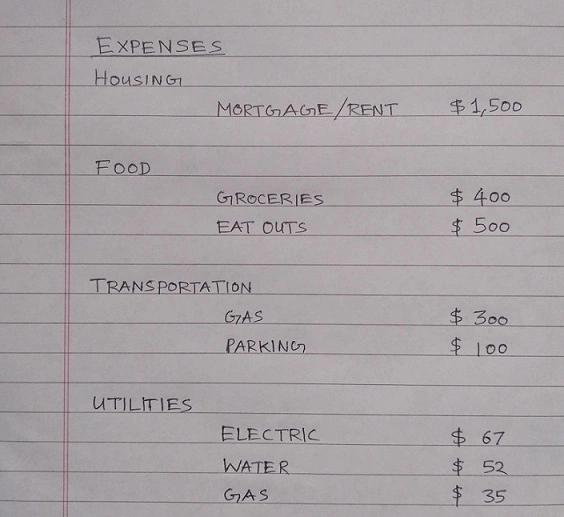

3. Make a list of all your expenses

Make a list of all your monthly expenses. There are two parts of expenses, Fixed expenses which mostly remain the same each month like rent and electric. Another part is variable expenses which change every month like groceries and lifestyle expenses.

If you are not sure how to calculate the money you need for housing, food, and lifestyle, then go through my post on budgeting.

Now, broke down your monthly expenses into categories like:

- Housing – monthly mortgage/rent you pay.

- Utilities – Electric, internet, water, sewage and gas costs.

- Food – Groceries, takeaways, coffee and eat outs.

- Transportation – Spending on gas, parking,

and repair of your car. - Debt payments – Car payments, student debt and credit card payments.

- Insurance & Taxes – Home insurance, car insurance, life insurance and taxes.

- Lifestyle & Recreation – Spending on clothing, cell phone, grooming and holidays.

- Healthcare – Visiting doctor, dental check-up and medications.

- Giving/charity – Giving gifts, donations or charity to church.

- Saving – Emergency fund, saving for home or retirement savings

If anything does not fall under these categories, put it as miscellaneous expenses.

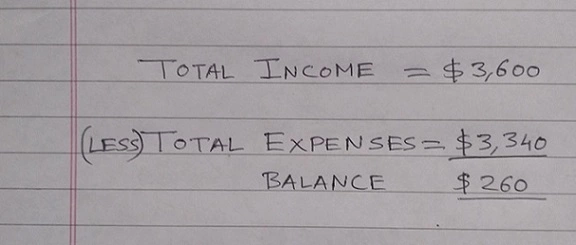

4. Finding the balance

In the next step, add all the income and expenses separately. And subtract total expense from the total income to find the balance.

The Outcome

If the balance is positive (+)

It means, your income is more than expenses. This is a very favorable outcome. Now, you can use this surplus money to make your finances even better. Like:

- Pay off more of your debt to get rid of the debt faster.

- Save to buy a new home or car.

- Invest surplus funds for more income, like in bank deposits, ETF or buying stocks.

- Save more for retirement.

If the balance is negative (-)

It means, your expenses are more than your income. You might be funding these expenses with your debt, I’m talking about credit cards. Now, this doesn’t look good, as you are spending all your income and nothing is left to save or invest.

To reverse the situation, you need to adjust your lifestyle by cutting back some of your expenses. Remember the basic costs of living like food, housing and transport are necessities which remains in your expenses, what you can control is cut back on lifestyle expenses like:

- Eat outs and takeaways.

- Shopping more than you need.

- Movies, streaming service or cable.

- Phone bill.

- Gym membership.

And the list is endless; you need to figure out where you are spending more as you know better. Try to reduce those expenses or look for cheaper alternatives.

5. Review and track your progress

After making the budget, now you know where you stand. You might have identified the categories where you need to cut back the expenses. Or the other way around, you might have planned how to employ the excess cash to achieve your financial goals.

Every month or week you need to compare your current spending/investing with the target you set. Change the goals or strategy if it’s not working. Try to stick to the budget and track your progress on this amazing journey.

Please pin it on your Budgeting board on your Pinterest

Final thoughts

Budgeting is not that complicated, give yourself some time to figure out which expenses are a

You need to do some trial and error with your budget, to find out what method suits you best. Cutting down expenses is not that easy, start gradually and make it a habit over time. In the same way, saving habits are developed slowly, just initiate your small step.

Very good post. Easy to understand. I was looking for an easy to understand way to budget to pass along to my two youngest sons, 26 and 30 yrs old. Thanks.

Thank you, Laurie, for the wonderful comment, I’m glad that my post helped your sons to understand the budget in an easy way.

Hey, this was very explanatory. In fact, I find information coming directly from someone who has implemented them much better. I love the way the community comes forward to help each other! There is another I read which helped me make my little siblings understand several aspects of budgeting.