Whatever may be your financial goal, one thing is for sure, you need to invest money to build wealth for the long term.

And whether your investments will grow or shrink depends upon the timing of those investments. Especially when you’re investing during inflationary times.

As you know, there are a lot of avenues to invest. You can invest in stocks, property, gold, cryptocurrency, and NFTs.

But there are certain assets that can turn out to be the worst investments during inflation. And that’s the main objective of this post.

What impacts investments during inflation?

As you’ve been hearing about the Federal Reserve tightening interest rates to curb inflation.

From March 2022 to March 2023 the Federal Reserve has raised interest rates nine times. From 0.08% to 5.00%

Because during inflation, as the prices of commodity rise, the purchasing power of people reduces. So they only spend on necessities like food and utilities and stop spending on everything else. This can lead to recession, the closing of businesses, and job losses.

The Federal Reserve has two major mandates, stable prices, and maximum employment. That’s why, to curb inflation, the Federal Reserve starts raising interest rates.

But because of these raising rates, certain sections of the economy get adversely impacted which can make your investment portfolio look bad.

Let’s look at some of the worst investment ideas you should avoid during inflation.

Worst investments during inflation

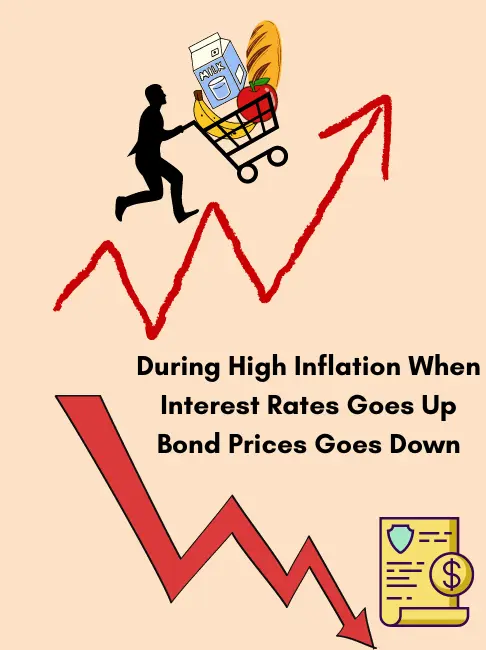

1. Treasury bonds and corporate bonds

Although, treasury bonds are considered to be the safest investment because it is backed by the federal government. But it is still susceptible to price movement in the bond market.

Let me explain, as the Fed raises interest rates, the bond prices fall and this phenomenon is very normal. Because the existing bonds were issued at low-interest rates.

And as the new interest rates take effect, the new bonds are issued at higher rates. So people tend to sell their old bonds to buy new bonds as they get higher returns. The demand for old bonds decreases, which results in price damage.

This same logic goes for corporate bonds as well, which makes these bonds the worst investments during inflation.

One can of course argue, we will buy the new bonds with higher interest rates. What’s the problem?

The issue is that, in a rising interest rate scenario, the Fed will continue to raise interest rates. Whatever new bonds you’ll buy will see a price correction every time rates are raised.

2. Stocks

Stocks generally do well when corporate revenues and earnings are growing steadily. But inflation changes this equation and eats away this growth.

Not all businesses are affected by inflation equally, companies like utilities generate steady income during this period but most of the consumer-facing company’s growth is impacted.

Because of this general slowdown in the economy, consumer demand is pretty low. Consumer-facing businesses especially, the entertainment, restaurants, hotels, airlines, travel, and leisure bear most of the brunt.

Why do consumers stop spending during inflation? Because people’s priority changes, they just want to spend on necessities like food, rent, and gas to preserve cash.

From the inflation point of view, stocks are usually a bad investment idea as they go down in value because of low demand, and high cost of borrowing which dent their profits.

Most of the prominent blue chip names fall under the consumer discretionary or the growth stock. Tech companies have always been the forerunner for this growth, as they promise great future growth prospects.

Why tech stocks are bad investments during inflation?

Well, there are two factors that make tech companies look unattractive for investment:

Availability of easy money: You must have seen, in the last few years when the interest rates were at rock bottom, Nasdaq and tech stocks were rallying, making new highs that have outperformed all the major indices. That was the result of a lot of easy money in the system.

When interest rates were low, the safer government bond offer very low returns which are not attractive. So, the investors were chasing the high-growth tech companies even though they are burning cash now but their future cash flow looks attractive. This easy money drives the stock prices of these tech companies through private equity and venture capital investments.

The game reverses when the Fed starts tightening the interest rates. Because of this, treasury bonds look more attractive and safer to investors, they stop investing in high-growth tech companies. And since these tech start-ups are unprofitable, their high valuation is unsustainable, so their stock prices go down.

High valuation: Another important factor to consider is their high valuations. These tech companies are mostly in red or loss-making, still, they have high valuations because their valuations are based on their discounted future cash flows. So, when the Fed raise interest rates, these tech companies’ valuations look more expensive and the investor took the flight to safety by parking their money in treasury bonds.

3. REITS

A real estate investment trust (REIT) is basically a company that owns a portfolio of real estate assets like commercial properties, malls, hotels, office space, and residential housing or apartment blocks. They are traded on stock exchanges the same as stocks.

REITs build and maintain these properties. They make money from the rental income or capital gains that come from the sale of these properties. And the REITs distribute 90% of this income to their shareholders in the form of dividends.

Like any other businesses, REITs also fund their projects through debt. During inflation, when the Fed raises the interest rates, their borrowing cost also goes up.

So they pay fewer dividends which pushes their REIT’s stock prices down. The other major factor that affects REIT’s price is the underlying demand for real estate.

Because due to inflation, when the Fed increases interest rates, the general economy cools down. People shy away from buying or leasing new properties as their borrowing costs go up.

Plus, the business environment gets weaker, so businesses are not willing to lease or rent commercial space. As demand slows, so does the value of these properties.

One should avoid investing in REITs during inflation as their stock prices go down because REITs derive their value through the underlying assets they hold.

4. Cryptocurrency and NFTs

The very same reasons apply to cryptocurrency and NFT as well. Because when the interest rates were already low, and we were hit by a pandemic. The federal government acted fast, helping Americans with stimulus checks.

That increased the money supply in the economy. People started putting money to buy tech stocks and crypto assets.

This excess liquidity in the market it flows to different assets that drive the value of those assets and cryptocurrency and NFT are no exception.

The tide turns when the Fed starts tightening the interest rates. Investors get out of these risky assets, and their price start to plummet. That money flows back to treasury bonds.

This makes cryptocurrency and NFT bad investments during inflation.

The bottom line

There is no doubt, investment should be done for the long term, but there are interest rate cycles that must be taken into consideration as they affect the value of our investments.

And we never know, how long the higher interest rates will last, so one should stay away from these worst investments during inflation.

So, during inflation, one should look for safe havens like gold, silver, and dividend stocks. And if you already own a residential property, that should also do well because during inflation or raising interest rates, people postpone buying new homes and the demand for rental properties goes up.