If you’re new to budgeting like me, you might have wondered, how to allocate my income to all the expenses. In what percentages?

In that case, Dave Ramsey’s budget percentages are your best guide.

Dave Ramsey is a well-known author and personal finance guru. Dave Ramsey’s baby steps have helped many to get out of debt, build an emergency fund and create wealth.

Budgeting can be tricky, especially when you’re just starting. A basic guideline can be very helpful to allocate expenses. Because there are many factors that govern one’s spending habits.

Each individual is different in the way they spend money. Let’s say one who lives near uptown spends less on gas compared to one who lives near the outskirts.

Your spending habit may vary based on your income, lifestyle, family values, the place where you live, and your aspirations. That’s where Dave Ramsey’s budget percentages help in tracking those expenses.

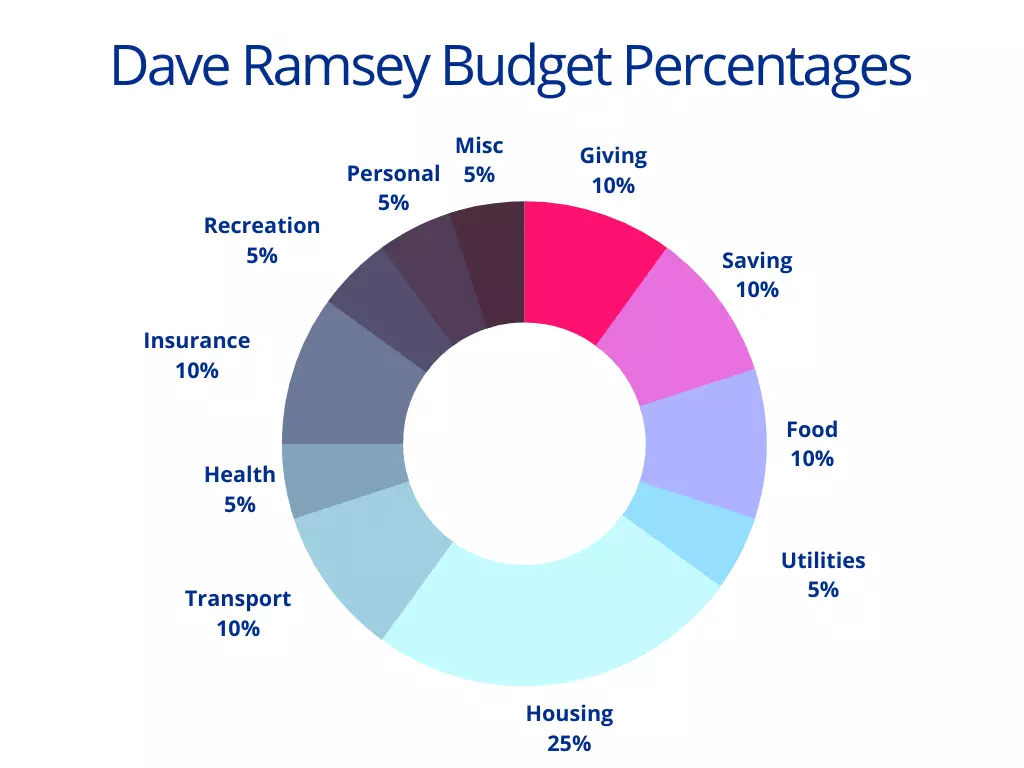

Dave Ramsey budget percentages is a tool that breaks down all the expenses into 11 categories. And each category has recommended percentages to allocate your income (after-tax).

Let’s take a closer look at the budget percentage!

Dave Ramsey Budget Percentages

Budgeting is the backbone of any money management plan. Remember, Dave Ramsey’s baby step number 1. Saving $1000 in an emergency fund.

And to start saving money, you need a budget to figure out how much money is left after spending your paycheck. Most of the expenses are divided into categories – food, utilities, gas, etc.

The main challenge is to decide how much money should be allocated to each category so that our saving goals are achieved.

Dave Ramsey has recommended certain percentages to allocate for 11 categories of expenses. These are:

- Giving 10%

- Saving 10%

- Food 10 to 15 %

- Utilities 5 to 10%

- Housing 25%

- Transport 10%

- Health 5 to 10%

- Insurance 10 to 25%

- Recreation 5 to 10%

- Personal spending 5 to 10%

- Miscellaneous 5 to 10%

Let’s take a closer look at each of these budget percentages.

Giving 10%

Dave Ramsey is a firm believer in giving a part of income to charity or church. Though, it’s a matter of individual choice. If you don’t share the philosophy of giving, it’s completely fine.

Giving is a positive mindset to be generous to share your wealth with the needy. You can allocate 10% of your income towards giving.

Saving 10%

Our main goal, in budgeting and managing money, is saving. Remember the golden rule of paying yourself first. Dave Ramsey recommends allocating 10% of income for saving.

If you don’t have an emergency fund then first you need to use this 10% to build an emergency fund. That is enough to take care of your six months’ worth of expenses.

Else allocate this 10% for retirement savings in 401k or IRA account.

Food 10 to 15 %

Though food is not the biggest expense of our disposable income. But we frequently spend on food, it can be groceries or takeouts. Here’s the USDA data

When you’re trying hard to get out of debt and save money. Then you need to keep a check on your food spending. As it’s very tempting to indulge in frequent eat-outs, coffee, and takeaways.

Dave Ramsey recommends staying within 10 to 15% of your income for food-related spending.

Utilities 5 to 10%

When it comes to budgeting, one of the important costs of living is utilities. It includes – electricity, gas, garbage disposal, and internet service. But as you know they are not constant.

Especially utilities like electricity and gas can be hard to predict because it highly depends upon usage and season. In winter you need more gas for heating and in summer air conditioning is required.

For this reason, Dave Ramsey recommends setting aside 5-10% of your income for utilities. But as you know 2022 is a crazy year for fuel prices and you have to shell out more on utilities. So, take a flexible approach to add a further 2-3% for utilities.

Housing 25%

If you talk to anyone, no doubt their biggest cost is housing. It includes rent or mortgages, HOA, insurance, and property tax. Dave Ramsey recommends spending up to 25% of your paycheck on housing.

I know this is not practical in today’s time with skyrocketing housing prices. This is just a guideline. In fact, in all the major cities including New York or Los Angeles, people are spending 30% plus on housing.

As Dave Ramsey mentions in baby steps – pay off mortgages early. You should definitely consider it. Plus, the golden principle of building an emergency fund is to take care of major housing repairs.

Housing is getting less and less affordable. The worst part is you can’t even cut down the rent or you have to shift to a low-cost city where you get fewer opportunities.

I leave it to you, how much % you spent on housing. But try to keep it low so it doesn’t eat away at your financial goals.

Transport 10%

The transportation cost should not be more than 10% of your income. To calculate transportation costs you can include – car payments, the cost of gas, car repair, and insurance.

If you’re commuting in a big city like New York, you can take into account the Uber or Lyft ride cost and subway costs.

Health 5 to 10%

Whatever your lifestyle is, health is everyone’s priority. If we put a percentage on how much we should be spending on health. It comes at 5 to 10% of income.

Health costs are the amount you pay for medical services. It can be dental checkups, visiting a doctor, prescriptions, medicines, tests, etc.

The best way to reduce health costs is to make an emergency fund in advance before you need to rush to ER.

Insurance 10 to 25%

Insurance is the very safety net for protection against any loss. Here, we’re talking about health insurance, car insurance, disability insurance, or any other risk you want to cover.

But the insurance cost depends upon a lot of factors. Take for example health, it depends on your age, previous conditions, your lifestyle, etc. These factors are similar in the case of a home, car, or any other form of insurance.

Dave Ramsey wants you to be mindful while spending for insurance in the range of 10 to 25% of your income based on your risk profile.

Recreation 5 to 10%

In recreation expenses, you can count all the fun activities you do for enjoyment. Starting from very basic entertainment like movie tickets, theme park tickets, eating outs, your gym, and streaming subscriptions – Netflix, Disney+, Hulu, and Spotify.

You can also add spending on birthday parties, date nights, vacations, foreign trips, music concerts, and game events.

Dave Ramsey recommends spending 5 to 10% on recreation and entertainment.

Personal spending 5 to 10%

All the personal spending you do while shopping online or at offline stores buying outfits, shoes, bags, and lifestyle shopping. The techy gadget we all love to buy also comes under this.

Visiting a spa, beauty treatment, haircut, and nails. Buying kid’s supplies. I can go on and on the list is endless.

Dave Ramsey recommends keeping these expenses within 5 to 10% of your paycheck.

Miscellaneous 5 to 10%

After allocating all the major expenses still sometimes pops up at the last moment. Any such expenses you can put under the miscellaneous category.

There are certain expenses that don’t fall under any of the categories mentioned above. For example, Christmas gifts, Halloween decorations, pet care, and babysitting. You can include them here.

Miscellaneous expenses should not be more than 5 to 10 % of your income.

Final word

Nothing is perfect, take Dave Ramsey’s budget percentages as a reference to allocate your expenses. So, that you can easily find out, where your money is going?

Take a practical approach considering today’s inflationary conditions in mind. Don’t worry if your expenses go beyond these recommended percentages for some time.

Remember the main goal is to save more money, that’s the point of budgeting. I hope these will be helpful in your journey to wealth.

If you find value in this post, please consider pinning the below image to your Budgeting board on Pinterest. It really helps me to reach more audiences.