Have you ever wondered, where all your money has gone at the end of the month?

Why my budget always fails? Unable to save any money.

Here is the solution, switch to Dave Ramsey’s cash envelope system of budgeting and see the difference.

A cash envelope system is a simple method of budgeting where you divide your monthly spending into categories and put them into envelopes.

Each time when you want to spend on something, look for the category envelope and make payment using the cash in the envelope.

Dave Ramsey’s cash envelope system keeps a check on how much you spend on each category. It ensures that you never spend more than you have in your envelope.

The cash envelope system was made popular by Dave Ramsey who is well known personal finance expert and podcaster.

Keep reading to understand how the whole process works.

What is Dave Ramsey’s envelope system?

As the name suggests, the cash envelope system is a cash-based approach to tracking your spending.

Take a few envelopes, and make a list of categories where you spend most of your money (say groceries, gas, or clothing). Name each envelope with its respective category and put the required amount of cash into it.

Every time when you walk into a retail store, you’ll only spend the limited money assigned to that envelope. There is no room to spend more so your spending will always be in check.

But the only catch here is digital payments. You need to avoid making payments through PayPal or Apple Pay or credit/debit cards.

As soon as your paycheck arrives, figure out all the expenses for the month. Create categories of all those expenses and write them on each envelope. And add the required cash for each category envelope.

Here are some of the categories that Dave Ramsey suggests:

- Grocery

- Clothing

- Entertainment

- Gas

- Miscellaneous

These are just basic categories, you can further add more based on your needs like – pet expenses, anniversary/birthday gift, kid’s allowance, visit doctor/treatment, beauty, and spa.

The cash envelope sounds pretty outdated, but believe me, these old tactics work very well to hack your mind to save more.

It’s not going to be easy. You have to make an effort to go to the bank teller or ATM to collect cash and separate bills based on denomination. Then put them into their category envelope. But it’s worth it if you’re determined to save more.

In the beginning, you’ll feel this method to be very daunting and may be tempted to use your credit card. But think like this, this is a discipline you have to develop to achieve your saving goal.

During a month, when your envelopes go out of cash, you will not add more cash until your next paycheck arrived. This will make sure you do not overspend.

The cash envelope system is only meant for expenses that are not fixed as we listed above. But for fixed monthly expenses like – car payments, insurance, utilities, and rent you don’t need to maintain separate envelopes. You can keep paying them online or whatever previous payment method you use.

How cash envelop system works?

First, we need to understand the human psychology of spending.

We all love the ease of doing things. Plastic money (credit card) or digital payments (Apple Pay) has made our shopping very easy.

We don’t need to carry a lot of cash at the grocery stores and no more fear of cash theft or leaving money somewhere.

But there is a downside to it. With the ease of plastic money or Apple Pay, we lost the emotional connection with our money. Now we tend to spend more and save less.

Money is not just a piece of paper, we have an emotional connection with it, once we purchase something, it goes out of our pocket, and it never comes back. Nobody wants to lose the cash.

But when you have a credit card, you virtually have unlimited money to spend and that’s the problem. Suppose you’ve only one option to pay with $55 in cash then there is no way you’ll spend more than that.

That’s the human psychology of spending.

Related posts

How the retail stores trick you to spend more

The worst part is that grocery stores are designed in a very clever way to trick your mind and make you impulse buying decisions.

Common tactics they use – displaying big discount % offers, buy one get one scheme, playing calm music to relax you, and placing the essential items in the last row so you have to walk past all other sections to attract you.

They encourage you to spend more. If you got a credit card or PayPal you, are more likely to spend more. One swipe or tap to pay and you have done.

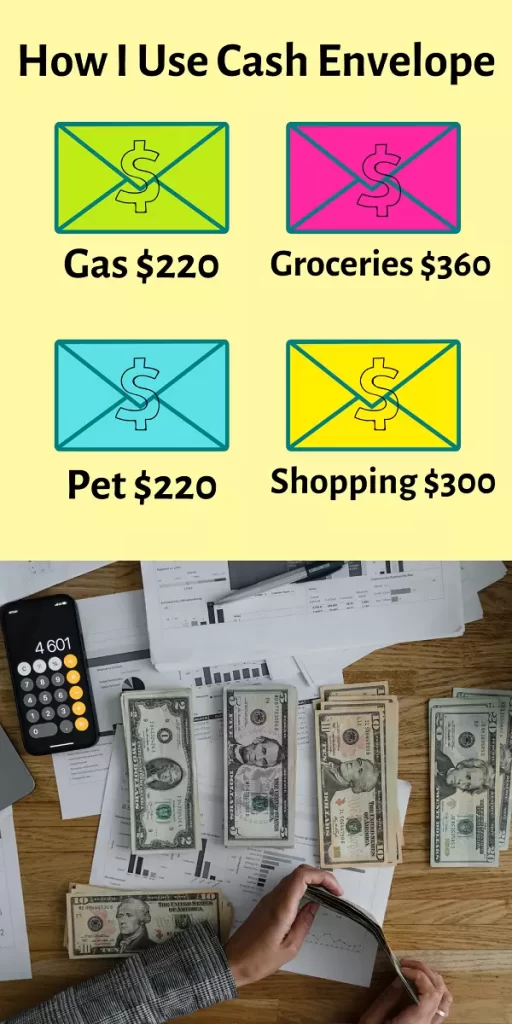

How I use the cash envelope system in my budgeting

- Gas – $220

- Groceries $360

- Entertainment – $450

- Shopping $300

- Pet $280

- Misc. $180

The digital cash envelope system

As I said earlier, this is a completely cashed-based system but in today’s time, everything is digital. How could the cash envelope system be practical?

You can do it in two ways:

Creating sub-accounts within your saving account

Certain banks like Ally Bank and Capital one allow you to create multiple sub-accounts within your saving account. These sub-accounts work like an envelope where you keep the money for a certain category.

When you want to spend from that category, the allocated money in that sub-account will be debited. This works the same as the physical envelope method but it’s a bit complicated.

Digital envelop apps

The second option is to use digital envelope apps like Cube Money and Mvelopes to track your spending.

Final word

Tracking your spending is a discipline that you have to master no matter whether you use digital apps or the cash envelope method. The core is to identify the areas of overspending and get rid of this habit.

If you find value in this post, please consider pinning the below image to your Budgeting board on Pinterest. It really helps me to reach more audiences.