If you’ve stumbled upon this article, then you must have heard about Dave Ramsey.

Dave Ramsey has been a big name in the personal finance space. People do listen to him when he speaks about debt and saving money for retirement.

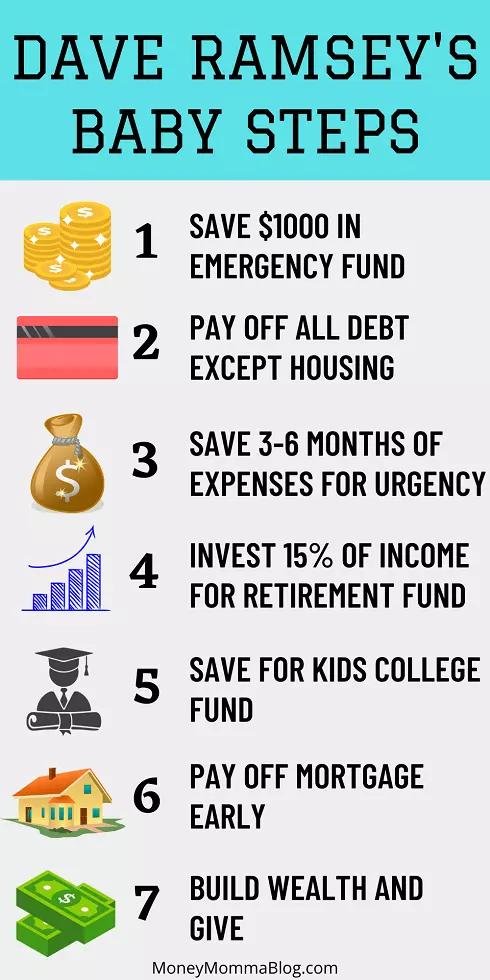

Let’s be honest, for many of us, personal finance topics are very complicated. To make that easy, Dave Ramsey has broken down them into seven baby steps to reach your financial goals.

If you’re having a hard time managing your money and planning for retirement, then Dave Ramsey’s baby steps will show you the right approach step-by-step in the order of priority.

As you know, life is full of uncertainties. One fine morning your car suddenly broke down and the repair cost you a fortune. If you don’t have an emergency fund, you’ll probably pay it with a credit card.

So, first, start building an emergency fund, and attack your debt with the snowball method (explained below). Your emergency fund should be sufficient to cover your 6 months of expenses.

Next, you need to plan your retirement by investing 15% of your income. Colleges keep getting expensive. So, don’t go for a student loan instead start creating a college fund for kids early.

Housing debt is huge so, try to pay off the mortgage early as possible. And the last step tells you to keep building wealth by investing and be generous to share it with the next generation.

Let’s take a closer look at each of the steps!

Baby Step 1 – Save $1000 in Emergency Fund

According to Dave, the first step in taking control of your finances is to create a $1000 emergency fund buffer. As I point out previously, we all go through rainy days sometimes in our life. An unexpected big expense is waiting for you. Be ready with your war chest to face that hardship.

Though in today’s time, $1000 is nothing still it is better than nothing. You can later add on more funds to create a larger pool. This is just a baby step toward creating good financial habits.

Look at it this way, if you don’t have an emergency fund, you will pay that bill with a credit card that will again drown you deeper into the debt. So, better be prepared.

When to use can my emergency fund?

- Major home repair.

- Major car repair.

- Medical emergency when someone is in ER.

- Job loss or your business shut down.

An emergency fund should never be touched for routine expenses. It should be kept in a separate bank account so that it is easily accessible on demand.

Baby Step 2 – Pay Off All Debt Using Snowball Method (except the house)

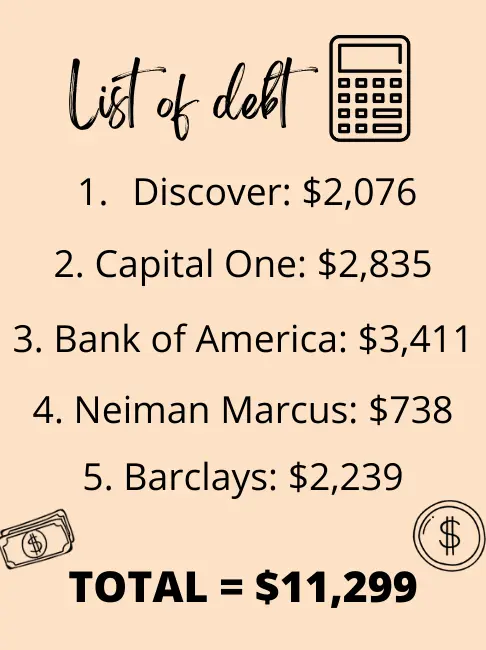

When you’ve got a pile of debt, you always get overwhelmed with where to start. Here Dave Ramsey’s snowball method to pay off debt comes to play.

Make a list of all debt you have from large to small, leaving aside the mortgage. Start with credit card debt, car payments, student loans, and so on. Begin with paying off the smallest debt first. And then move to the next one.

The whole idea behind snowball is that when you pay off your smallest debt first, you have left with more money on your next payday.

Put that extra buck to pay off the next bigger debt. It’s like a snowball that gets bigger and bigger as you pay off the previous small debt. You have more funds to attack the larger debt.

This is the fastest way to destroy your mountain of debt. One of my colleagues, Ronny has destroyed his $20,000 car debt in less than 3 years using the snowball method.

Baby Step 3 – Save 3-6 Months of Expenses in The Emergency Fund

Now since you paid off all of your major debt using snowball, you have more cash to save. This is the right time to further increase your emergency fund to cover 3-6 months of expenses.

We have discussed in point number 1 to create an initial $1000 emergency fund. This was just the start; in reality, we need more money to cover any emergency.

Based on your current lifestyle expenses, you must have an emergency fund to cover 3-6 months of expenses. Keep saving that extra money with that goal in mind.

Emergency funds are the safety net that prevents you from falling back into debt. Each year things are getting expensive, don’t get complacent and keep adding till you’re covered fully.

Baby Step 4 – Invest 15% of Income Towards Retirement Fund

The 4th baby step of Dave Ramsey tells you to invest at least 15% of your income towards a retirement fund. This can be done in 401k or Roth IRA based on your age.

For those whose employers are matching 401k, let’s take it as 3% you also contribute the same 3% which takes the total to 6%. Now you have room for an additional 9%. Invest this 9% in Roth IRA.

Get more insight into it through this video.

That 15% is the minimum recommendation, if you’re young and already paid off much of your debt then you may consider putting higher than 15% of your income towards retirement.

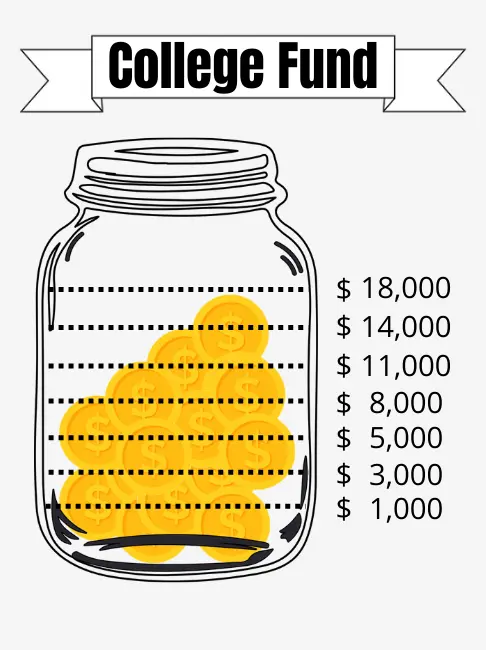

Baby Step 5 – Save For Kid’s College Fund

As university costs are skyrocketing, today’s student loan is the biggest debt trap for our Gen Z kids. Before they start earning, they are drowning in debt.

For that reason, Dave Ramsey is not in favor of taking student loans for kids. Instead, he suggests saving early into a college fund. This can be in – The education saving account or Education IRA.

Based on the age of your kids, do some number-crunching to find out how much money they’ll need for their college. And start a college fund soon. Check out the resource on how to start a college fund.

Baby Step 6 – Pay Off Mortgage Early

After destroying your credit card debt, car payments, and student loan. Now comes the mother of all debt, the mortgage. The reason is, that the amount that goes to pay off a home is huge and that too payable for a very long period of time.

The worst part is the interest that you pay on this loan. If you’re taking a 30-year loan, you can imagine how much interest you are paying. It all adds up and seems like you’ll never get out of this burden.

What can you do to ease this burden?

The best thing you can do is make an extra payment to your mortgage loan principal. If you’re able to make an extra payment of $150 per month above your regular monthly payments.

It has got a double advantage; it shortens the period of your loan plus saves you thousands of dollars in interest payments.

Whenever you get extra money – say a bonus, windfall gains, tax refunds, or by selling any valuables use that money to pay off the additional principal on your mortgage.

You can do this in both ways – Lum sum payment or paying some extra dollars each month to reduce the principal.

Baby Step 7 – Build Wealth & Give

Now, since you have paid off all your debt, you got a sufficient emergency fund, and actively investing toward your retirement fund. As your finances are in good shape, it’s time to build wealth.

This is the stage that we called financial independence. The whole objective of Dave’s baby steps concludes here, one thing still remains, giving.

Happiness is not about accumulating a lot of wealth; real happiness comes from giving. Be generous to share your wealth with your loved ones and community.

Money can be a great tool to help a needy person. Look around your community to find people who don’t have enough and help them.

Final Words

Dave Ramsey’s baby steps are the blueprint to get out of debt and achieve your financial goals. These baby steps show you how to get your finances in order.

Debt is the biggest hurdle in our financial journey. Pay off all debt with the snowball method, create an emergency fund for urgencies and start saving for college early to avoid student debt.

Invest 15% of your income for retirement, and pay off housing debt early by making extra payments for the loan principal. Then keep adding wealth and share it with the needy.

If you want to become debt-free and create wealth in long run, apply these baby steps earlier to reap the benefit later.

If you find value in this post, please consider pinning the below image to your Personal Finance board on Pinterest. It really helps me to reach more audiences.