Starting with an awkward question:

How much debt do you carry? And when do you see yourself out of debt?

Let’s face it! debt is our biggest challenge in managing our finances.

But borrowing is not that bad. In fact, we can use debt in our favor by taking student loan to shape our career, auto loan gives us ease of commuting, and credit cards allows us to buy now and pay later.

Everything is fine till we stay within the limits. In the case of debt, that limit is your income. Things get out of hand when you accumulate too much debt in comparison to income.

If you’re in the same situation, then you’re not alone. The data from the Federal Reserve Bank of New York point outs that barring mortgages, the biggest debt of an average American is student loans, auto loans, medical bills, and credit card relared debt.

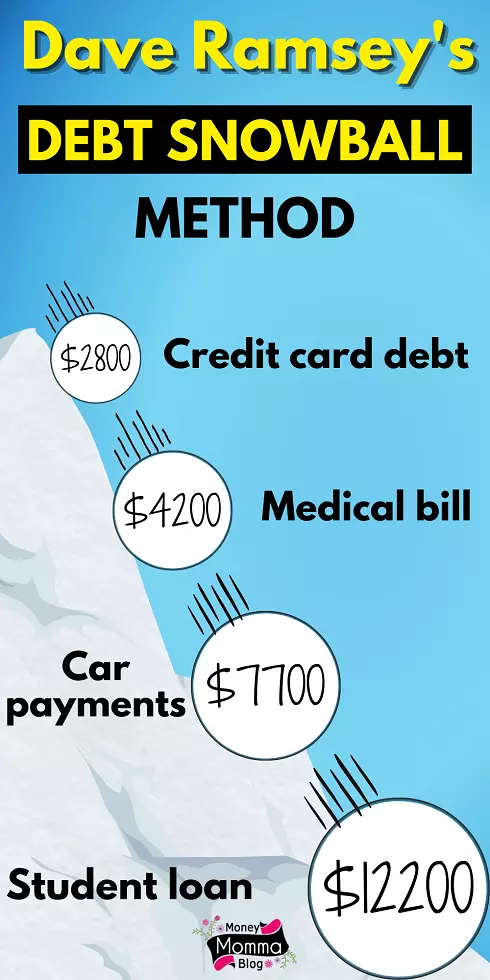

At that point in time when the mountain of debt gives you sleepless nights. It’s time to revamp your debt payment strategy. And that’s our topic for today – applying Dave Ramsey’s debt snowball method to pay off debt.

What is the debt snowball method?

The debt snowball is a way of paying off your debt made famous by Dave Ramsey. The debt snowball method focuses on paying off the smallest debt first and then moving on to pay off the next bigger debt (except the mortgages).

Here the whole idea is to establish a positive mindset. Once you pay off your smallest debt, it gives you confidence that you can do it. Build that momentum to attack the next bigger debt till you finish off all the debt.

There is a reason, why it is called snowball. When a small snowball rolls downhill, it gets bigger and bigger while it’s rolling. The same is the amount of your debt repayment. Once the smallest debt is out, now you’ve more funds to put into repaying the bigger loan.

The starting will be slow as you pay off the smallest debt for a few months. But remember, moving the needle is more important. In this way, you’ll pay off your bigger debt in less time and become debt-free faster.

How does the debt snowball method work?

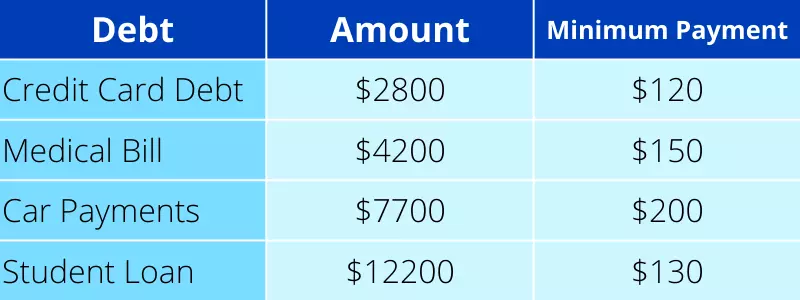

I’ll show you a practical example of how the debt snowball method work. Let’s say you have four debts:

- Credit card debt $2800. Minimum monthly payment is $120

- Medical bill $4200. Minimum monthly payment is $150

- Car payments $7700. Minimum monthly payment is $200

- Student loan of $12,200. Minimum monthly payment is $130

If we apply the debt snowball method here, we’ll go with the smallest debt first i.e., credit card debt. We keep paying the minimum payments on all other debts.

Let’s assume you got a side hustle and make an extra $280 from it. Now, you’ll add this extra $280 to the credit card minimum payment to make it $400 so it gets paid in 7 months.

After 7 months, once you destroyed your credit card debt, then move on to the next smallest debt i.e., medical bills. Use that same extra $400 towards paying for the medical bill. By paying $550 (minimum payment $150 + extra 400) you’ll finish off the medical bill in less than 8 months.

As you can see, your snowball is getting bigger and bigger when you pay off the smallest debt. After the medical bill when you approach car payments, you have an extra $550 to put over $200 of the minimum payment for the car.

Similarly, when car payments are cleared you now have an extra $750 to pay off your student loan. With every small debt you pay off, you have a bigger pool of funds to attack the next bigger debt.

How to use the debt snowball method

In just four easy steps you can implement the debt snowball method to become debt-free.

Step 1 – Make a list of all the debts except mortgages

Arrange all the debt from the smallest to the largest, irrespective of their rate of interest. You can include car payments, medical bills, student loans, and credit card debt (except mortgages).

Step 2 – Start making an extra payment on the smallest debt first

Once you figure out the minimum payment on each debt, keep paying it. But for the smallest debt (credit card in our case) start making an extra payment to pay off that debt early.

To fund that extra payment, you’ve two options – 1) If you have enough income to save more, use it or save money by cutting down your unnecessary expenses. 2) Start a side hustle that you’re good at. You can also work on weekends to earn extra money.

Step 3 – Once the smallest debt is paid, use that extra cash to attack the next smallest debt

When you pay off the smallest debt, you have one more source of funds now. Since you don’t have to pay the minimum payment on the smallest debt, use that extra cash to pay off the next debt (medical bill in our case).

You’ll see a drastic reduction in your debt position because you’re paying off debt faster thanks to the extra cash you left by paying off previous debt. That’s the key strategy.

Step 4 – Rinse and repeat

You must rinse and repeat this process on all other debts till you destroy them. In our case, as you pay off your medical bill, now you have even more funds to pay off the car payment. Do the same with student loans once the auto loan is paid off.

Debt tracker printable PDF free download

A simple way to track your debt payoff is through a printable PDF. In the first column, list down all your debt from smallest to largest except mortgages.

In the next column write the total amount due on each debt and enter minimum payments for each debt in another column.

Based on your saving or side income, set aside extra money to pay off the smallest debt first and write it down in the last column. Keep track of it till the debt is paid off.

Do the same for the next debt as well.

Get the Debt tracker printable PDF free download

If you find value in this post, please consider pinning the below image to your Debt Payoff board on Pinterest. It really helps me to reach more audiences.