It was not so long back; I was very horrible with my money.

Yeah, you guessed it right. I was spending on clothes, eating out, and indulging myself in every possible way. And when I look back to my bank account at the end of each month, a big regret.

I’ve no idea where all my money went. My finances were out of order. And I realized, I need to fix this thing asap.

Yeah, I’ve heard about budgeting but not sure where to start. I would be glad if they taught us in school. So I searched on Google, how to make a budget.

There are plenty of guides very promising – 5 easy steps to create a budget, lots of excels or worksheets. It was nice but…. It wasn’t great for me.

Because the problem is that all those worksheets and step-by-step guides don’t fit my needs.

All those budget gurus tell us to allocate a certain percentage of our income towards each expense.

But as a beginner, I don’t know how much I need for food, clothing, and transportation.

The fact is, most of us face the same problem while making our budget.

Am I right? I’m sure you’ll agree.

It took me a while to understand and, with some trial and error, I figured out an easy way to find my monthly expenses in each category.

This method helped me a lot in making my budget really easy and trust me you’ll also find it very useful to make your budget.

Today I’m going to share my way of budgeting. I’m sure you’ll find the solutions to your budgeting problems with it.

Finding your living expenses

It’s all about identifying your essential costs of living.

So, here’s how I started.

It’s an old-school method. So, to find my monthly expenses in each category. I started with a simple exercise.

Please bear in mind, this exercise will take some time to figure out your average spending. It will take a few weeks to a month, depending upon when get paid.

You don’t need a worksheet or an app. Take a piece of paper or notepad and wrote down each day’s expense.

A few things to remember

- Note down all types of transactions, whether you pay by card, online or cash.

- Note down every single payment, daily check your credit card or bank account summary.

- Make sure you do it daily without fail.

- If you get paid monthly, do it for each day for a month.

- If you get paid weekly or bi-weekly, do it for each day of that week(s).

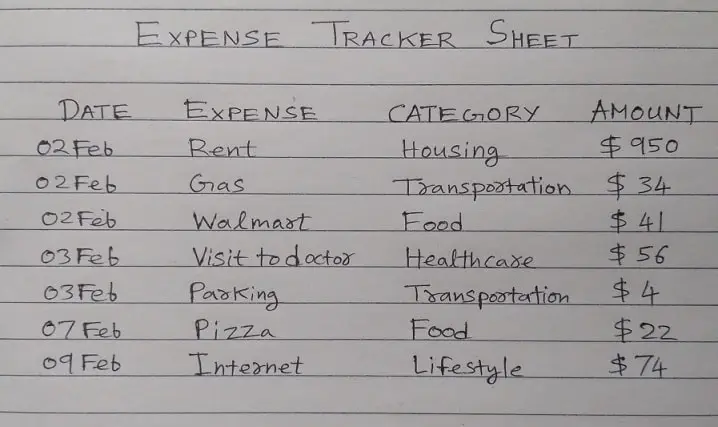

Expenses tracker sheet

To find your monthly living expenses, you need to classify your monthly expenses into categories like food, housing, transportation, and so on.

For that, create an expense tracker sheet, which has four columns.

- Date – The date of expense

- Expense – The description of the item you spent on

- Category – The category under which the expenses comes

- Amount – The amount you spend

Here is a quick snapshot for your reference

The list of categories to allocate your expenses:

- Housing – monthly mortgage/rent you pay

- Utilities – Electric, internet, water, sewage and gas costs

- Food – Groceries, takeaways, coffee and eat outs

- Transportation – Spending on gas, parking,

and repair of your car - Debt payments – Car payments, student debt, and credit card payments

- Insurance & Taxes – Home insurance, car insurance, life insurance and taxes

- Lifestyle & Recreation – Spending on clothing, cell phone, grooming and holidays

- Healthcare – Visit

to the doctor, dental check-up and medications - Giving/charity – Giving gifts, donations or charity to church

- Saving – Emergency fund, saving for home or retirement savings

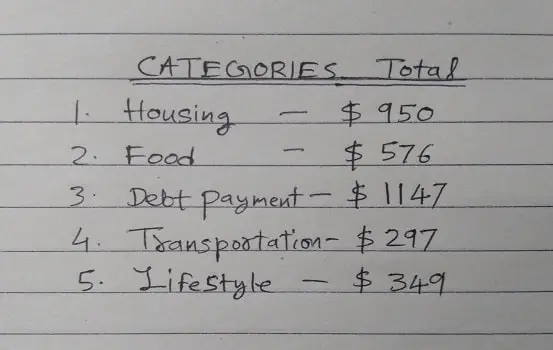

Once the week or month is over, sit down with your calculator and add all expenses for each category and find the total.

For example, In Transportation – Expenses for gas is

1 February – $12

3 February – $18

5 February – $5

6 February – $24

Total of transportation category is = $59

Similarly, do the total for other categories as well. Here is a snapshot of the total for each category for the month.

Note: Some of the payments like rent/mortgage, car payment, student loan, or insurance might be paid once a month, but expenses like food, lifestyle, and others are recurring.

Once you do this simple exercise every week or month you’ll get a grip on how much money you need for food, housing, transportation, and other things in your life.

There is also an alternative method of identifying your expenses:

1. Collect all your bank statements, mortgage statements, cars payments, and car payments.

2. Collect all your utility, gas, cell phone, and internet bills.

3. Also, include shopping and groceries bills.

Add all those items to find your monthly expenses. But the downside of this method is you need to carefully keep all the monthly or weekly bills in one place.

I know it’s very difficult to track it all as some statements/bills are only available online and some are on paper. Sometimes it gets duplicated. I have tried it all, but have not found it useful so I stick with my method.

This is not the last word as life is full of surprises. You may still have to pay for some unexpected expenses. But this is an average estimate of your monthly or weekly cost.

So now you know your living expenses, it is much easier to make a budget which suits your needs. This will help you to cut down the wasteful expenses from your budget to save more or pay down your debt faster.

Check out this post to know more about how to make a budget for beginners.